Provident Fund – What you need to know

The Employees’ Provident Funds & Miscellaneous Provisions Act, 1952 applies to all states in India except Jammu and Kashmir. The purpose of a provident fund is to provide financial security and stability to elderly people on retirement. When one begins employment, they are expected to contribute on a regularly basis (typically monthly) to their PF fund. The employer is also expected to contribute to its employees retirement fund.

In Oct 2014, the Employees Provident Fund Organization (EPFO) launched a Universal Account Number (UAN) where every employee was given a unique Provident Fund (PF) account number which is not associated with the a particular employer. Therefore, an employee can now change a job without having to transfer funds from one account to another.

Which Businesses does PF Apply to?

The Employees’ Provident Funds & Miscellaneous Provisions Act, 1952 applies to:

– Any business or establishment within these industries (Industry List) or any activity notified by Central Government in the Official Gazette

– Employs 20 or more employees (including contract workers)

– Applicable to cinema theaters with over 5 employees

– Once registered, a business will continue be applicable and liable under the Act even if the employee count falls below 20 persons

– Business that do not meet the criteria above can choose to voluntarily register with the EPFO under Section 1(4) if the employer and employees are both willing

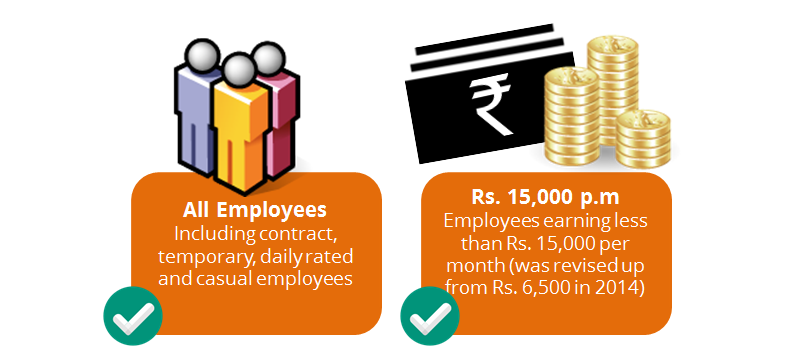

Which Employees are eligible for PF?

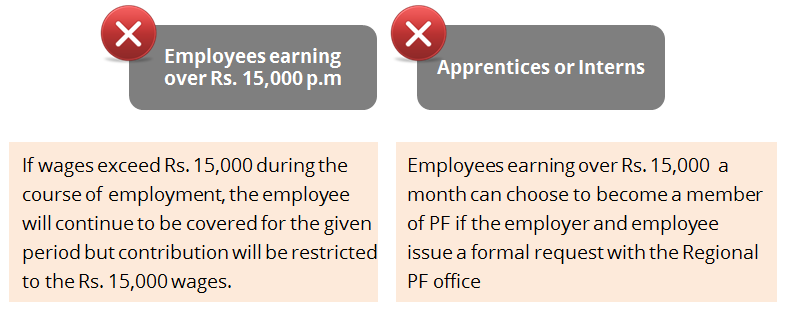

PF Contributions

Below is a summary of the required contributions to PF by employee and employer. The Employees contribution is matched by the Employer till 12%. PF and EPS (Employees’ Pension scheme) are calculated on basic salary, dearness allowance (DA), cash value of food concession and retaining allowances if any. Most companies base it of (Basic + DA).

|

Contribution

|

Employee

|

Employer

|

| Provident Fund |

12%

|

3.67%

|

| Employee Pension Scheme |

0%

|

8. 33%

|

| Exemptions |

– Not tax exempt |

-Tax exempt

|

Admin Fees (as per Jan 2015 revision)

EPF Admin Charges

- 0.85% of total employee PF wages

- Minimum of Rs. 75 per month in the case of an non-functional establishment having no contributory member

- Minimum of Rs. 500 per month for contributory members

EDLI Admin Charges

- 0.01% of total EDLI salary

- Minimum of Rs. 25 per month in the case of an non-functional establishment having no contributory member

- Minimum of Rs. 200 per month for contributory members

What Happens to Your Contribution?

All employee PF contributions are pooled into a fund and earn an interest at a Government set annual rate which is generally higher than the prevailing market interest rate. Interest is credited to the account on a monthly basis.

You can check your current EPF balances here: http://www.epfindia.com/site_en/KYEPFB.php

Or you can also give a missed call to 011-2290-1406 from your registered phone number.

What is PPF? How is it different from EPF?

Wondering what Public Provident Fund (PPF) is and how it is different from EPF?

PPF is totally controlled by you without involvement from your employer, unlike the EPF. Moreover, anyone even in the unorganized sector can invest in PPF, while EPF is eligible only to salaried employees.

PF Withdrawals

- If you go 2 months without employment, you are currently eligible to withdraw 100% of your PF balance

- If you withdraw the PF balance before completing 5 years of service and if the PF settlement is equal to or exceeds Rs.30,000, you will be subject to a TDS of 10% with a PAN card and 34.608% without a PAN card at the time of settlement

TDS is exempt if:

- Transfer of PF from one account to another PF account

- Termination of service due to ill health of member /discontinuation of Business by employer/completion of project/other cause beyond the control of member

- If employee withdraws PF after a service period of five years

- If the PF balance is less than Rs. 30,000

- If employee withdraws amount more than or equal to Rs. 30,000, with service less than 5 years but submits Form 15G/15H along with their PAN. Form 15H is for senior citizens (60 years & above) and Form 15G is for individuals having no taxable income

The Government is on the brink of lowering the withdrawal limit to 75% of PF balance. The EPFO will retain 25% of PF till retirement and you will continue to earn interest on the remaining balance

Form Nos. 15G and 15H cannot be accepted if amount of withdrawal is over Rs. 2,50,000/ and Rs. 3,00,000 respectively

Latest Developments in PF

Effective August 2015, here are the latest developments:

PF settlement made quicker

The Employees Provident Fund Organization (EPFO) has reduced the PF settlement time. Pension and insurance claims will now be settled within 20 days versus the previous 30 days

EPFO does away with mandatory revenue stamps on PF withdrawal claims

EPFO has done away with the mandatory requirement of affixing a one rupee revenue stamp on PF withdrawal claim forms thereby easing the process for claimholders.

Further improvements to the PF settlement process

97% of PF settlement will now be made through National Electronic Fund Transfer (NEFT). Additionally, there is a proposal to remove employer attestation for when the employee has his KYC information (Know Your Customer) seeded and has an active UAN.

New Employee? Here’s what you need to do…

There are 2 relevant forms when you hire a new employee:

FORM 2

- To be filled by the employee

- Contains employee’s personal information and nomination

- Also used to change nominee names

- Employee eligibility begins on the joining date

- To be submitted to the PF department within 30 days of joining

- Employee can now enter details through his / her online UAN account

FORM 11

- Declaration of an employee, not previously registered with EPF and not covered under PF (Higher than Rs. 15,000 basic salary)

- Not to be submitted to PF office

- To be kept with employer and shown to PF department during inspection

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none”][fusion_code]PGRpdiBhbGlnbj0iY2VudGVyIiBzdHlsZT0id2lkdGg6MTAwJSI+W2J1dHRvbiBsaW5rPSIvcmVzb3VyY2UvcHJvdmlkZW50LWZ1bmQvIiBjb2xvcj0iY3VzdG9tIiBzaXplPSJ4bGFyZ2UiIHR5cGU9IiIgc2hhcGU9InJvdW5kIiB0YXJnZXQ9Il9zZWxmIiB0aXRsZT0iIiBncmFkaWVudF9jb2xvcnM9IiNlYjdmMzciIGdyYWRpZW50X2hvdmVyX2NvbG9ycz0iI0ZGRkZGRiIgYWNjZW50X2NvbG9yPSIjRkZGRkZGIiBhY2NlbnRfaG92ZXJfY29sb3I9IiNlYjdmMzciIGJldmVsX2NvbG9yPSIiIGJvcmRlcl93aWR0aD0iMnB4IiBzaGFkb3c9IiIgaWNvbj0iIiBpY29uX2RpdmlkZXI9InllcyIgaWNvbl9wb3NpdGlvbj0ibGVmdCIgbW9kYWw9IiIgYW5pbWF0aW9uX3R5cGU9IjAiIGFuaW1hdGlvbl9kaXJlY3Rpb249ImRvd24iIGFuaW1hdGlvbl9zcGVlZD0iMC4xIiBjbGFzcz0iIiBpZD0iIl1Eb3dubG9hZCB0aGlzIGFydGljbGUgYXMgYSBQREZbL2J1dHRvbl08L2Rpdj4=[/fusion_code][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]