Powering Payroll Precision for Indian Businesses

Automate payroll with precise compliance and effortless accuracy, designed for India’s unique payroll requirements

Trusted by over 5000+ HR Managers

Simple, Accurate Payroll Software

Optimize payroll management with these powerful and efficient features.

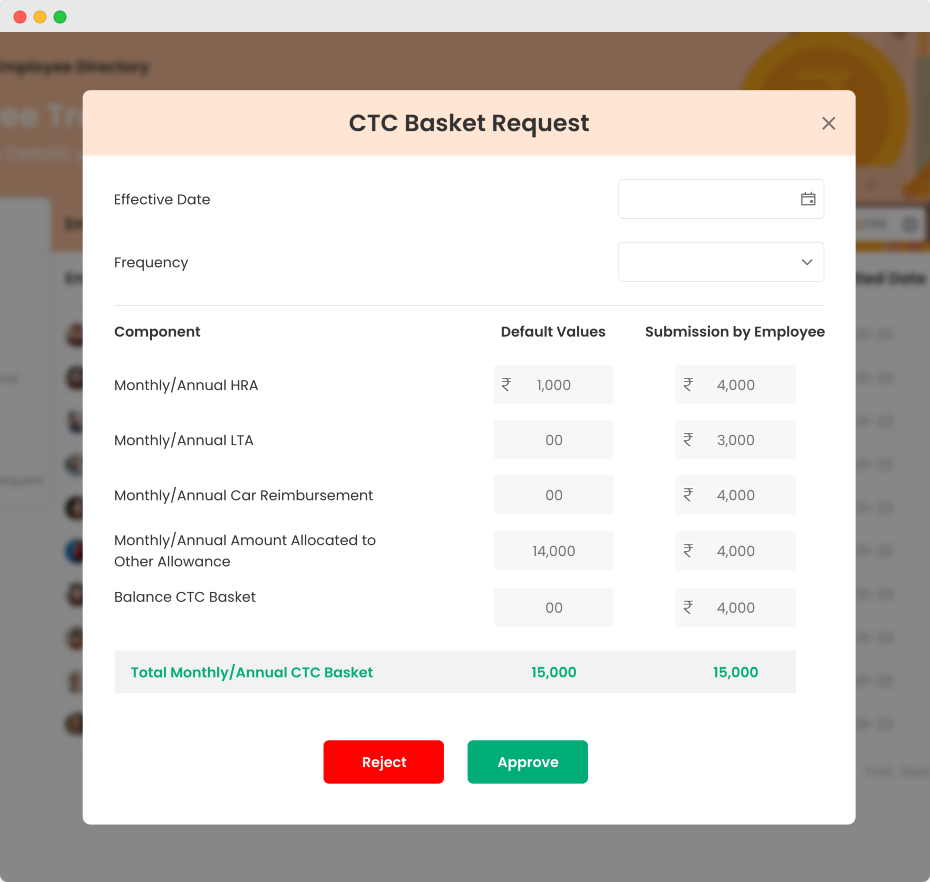

Custom Salary Structures

Easily create and manage salary structures that fit your organization’s needs with flexible pay heads and CTC templates

-

Configurable Pay Heads: Customize pay components like basic, HRA, allowances, and more

-

CTC Templates: Define reusable templates to standardize salary structures across employee groups

-

Flexible Salary Components: Support diverse compensation models for different roles

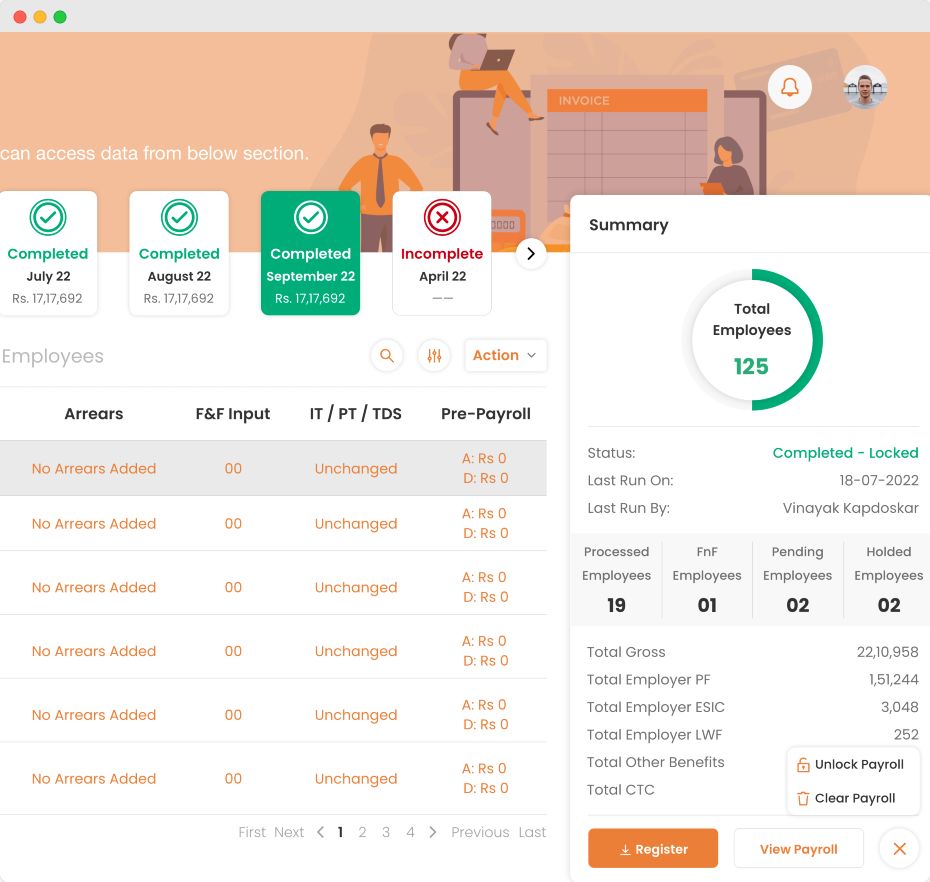

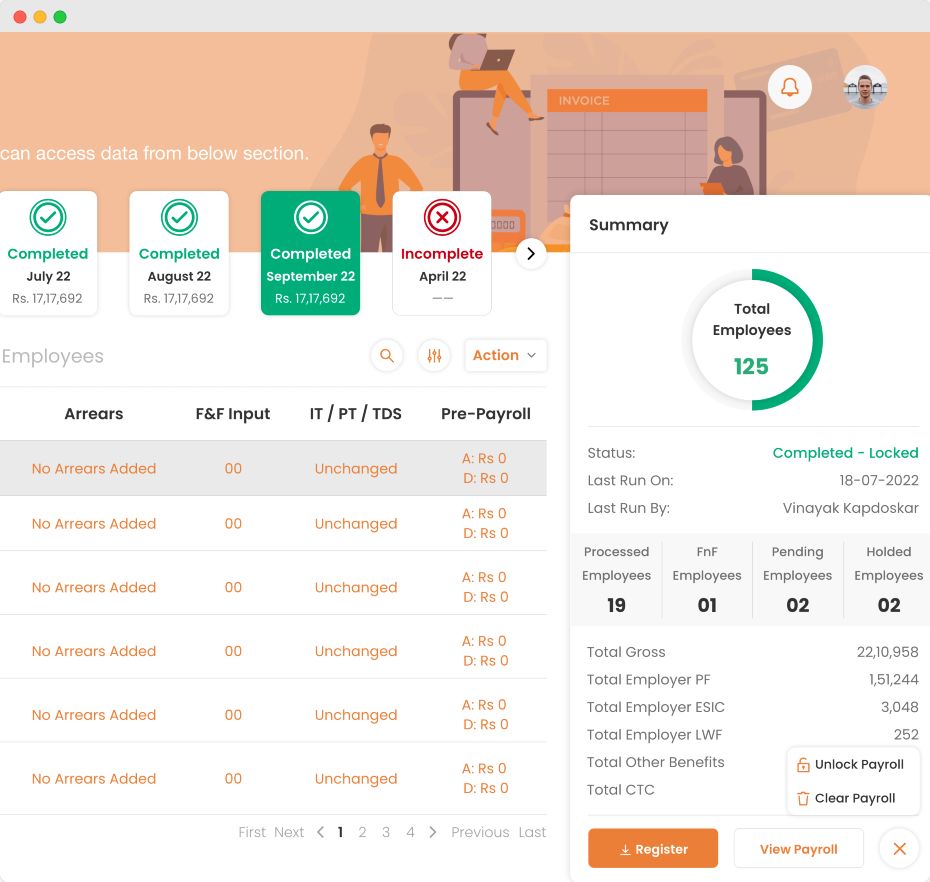

Effortless Payroll Processing

Streamline payroll with minimal steps and automated calculations, covering all payroll elements

-

One-Click Calculations: Process payroll in just a few clicks for smooth monthly workflows

-

Comprehensive Payroll Coverage: Handle variable payments, arrears, gratuity, TDS, PF, ESIC, and other statutory deductions effortlessly

-

Automated Compliance: Ensure all calculations adhere to statutory requirements

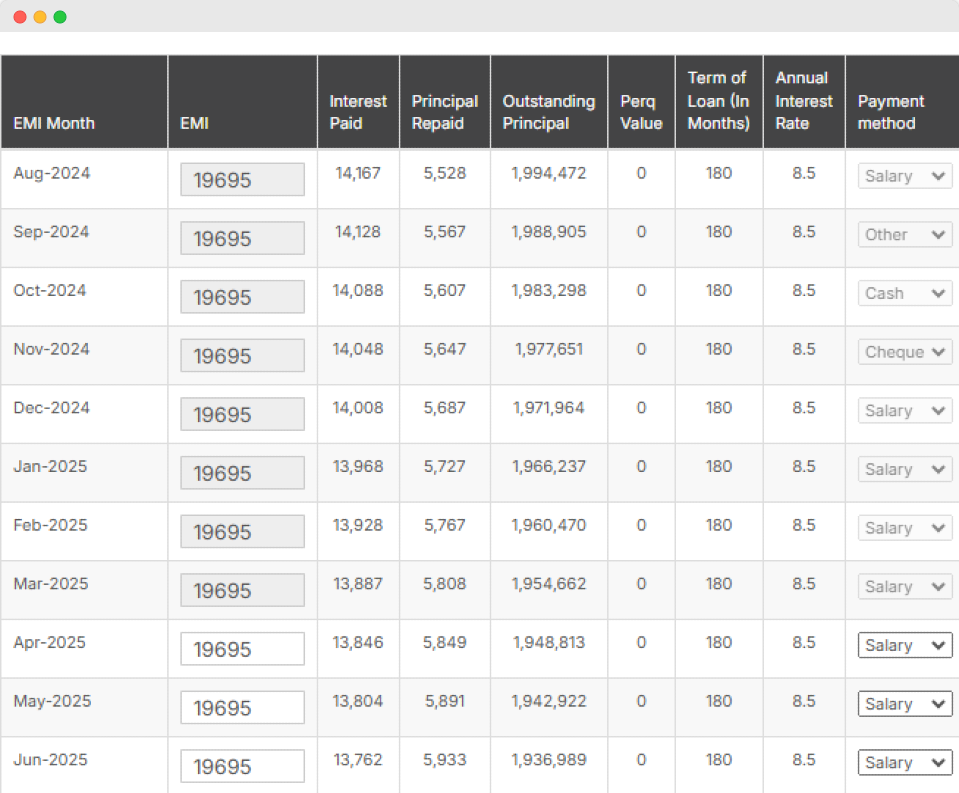

Loan Management

Track and manage employee loans and advances, with automatic deductions integrated into payroll

-

Easy Application: Emplyoyees have the ability to request for advances or loans from their ESS Portals

-

Flexible Repayment Plans: Configure loan repayment schedules based on policies

-

Auto-Deductions: Automate deductions directly from employee salaries

-

Detailed Loan Records: Maintain a record of loan balances and repayment histories

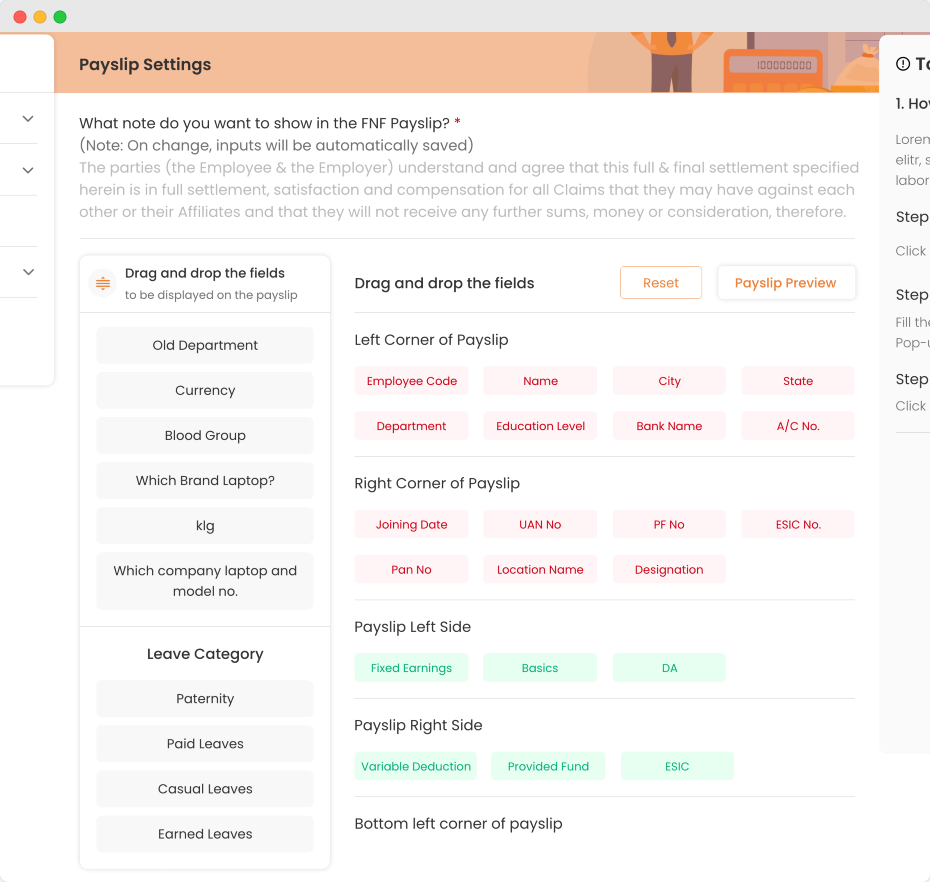

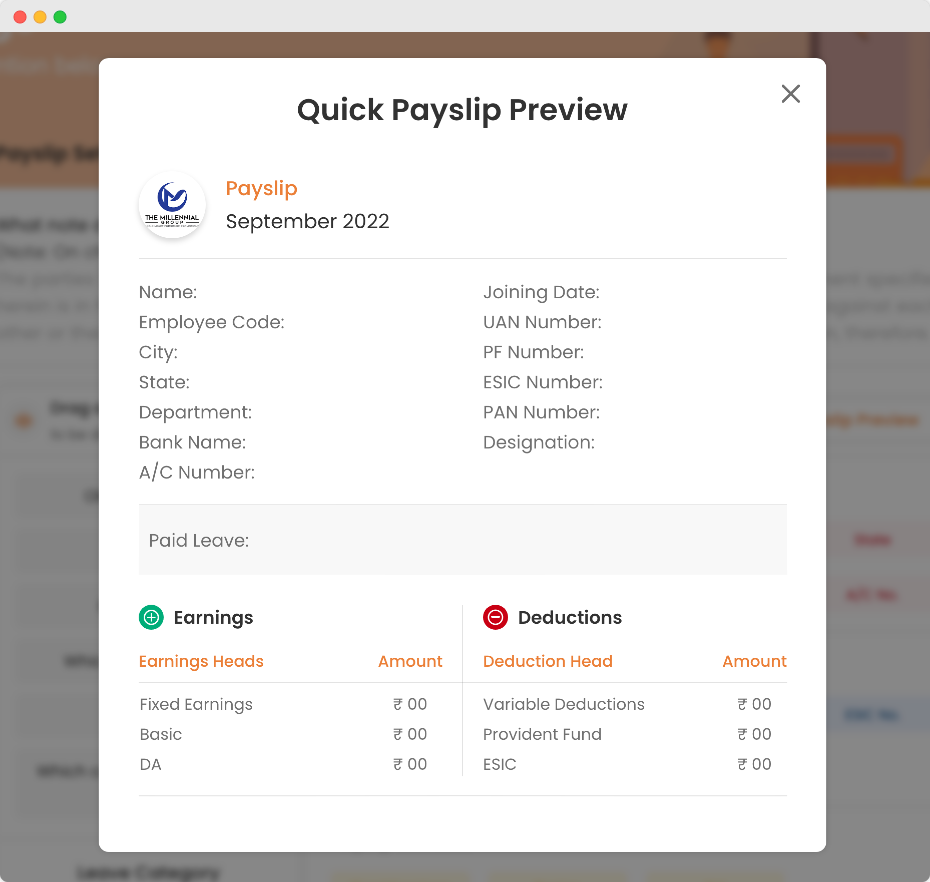

Custom Payslips

Generate detailed, branded payslips that reflect your organization’s unique pay structure and style

-

Customizable Payslip Templates: Add your logo, adjust format, and highlight pay details

-

Detailed Breakdown: Provide a comprehensive view of earnings, deductions, and net pay

-

Digital Distribution: Distribute payslips through email or ESS for easy access

Salary Disbursements

Ensure smooth salary disbursements with automated bank reports and file generation

-

Auto-Generated Bank Reports: Generate bank files compatible with major banks for quick processing

-

Seamless Disbursement: Disburse salaries with minimal manual intervention

-

Reconciliation Support: Track disbursements and resolve discrepancies easily

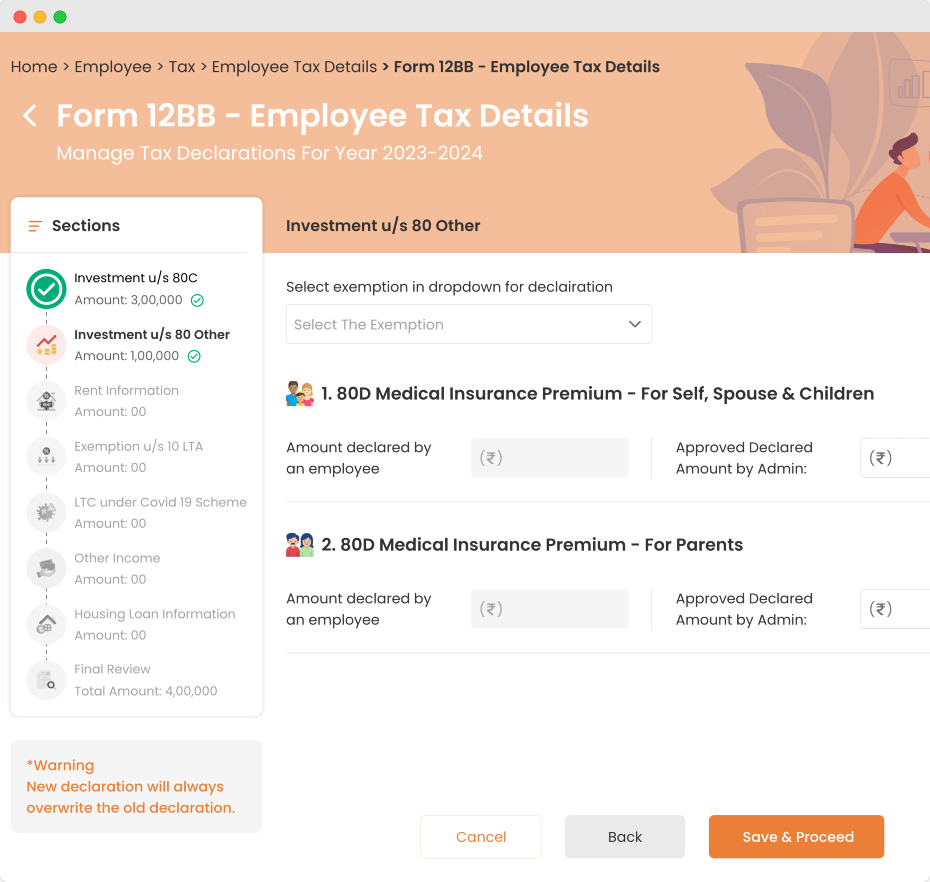

Investment Declarations

Simplify investment declarations and tax calculations with support for proof submissions and accurate deductions

-

Employee Declarations: Enable employees to declare investments and submit proofs digitally

-

Automated Tax Calculations: Ensure precise tax deductions based on declared investments

-

Year-End Compliance: Easily generate Form 16 and other tax forms for compliance

Testimonials

Hear from our users

The Quikchex HRMS platform has been a valuable addition to our HR processes at IIDE. The employee directory works seamlessly, and the leave process setup is intuitive, helping streamline approvals efficiently. The payroll and attendance management modules have also been reliable and easy, making our HR operations smoother.

The user-friendly Quikchex interface has streamlined our processes, saving valuable time. The payroll and attendance system ensures accurate, timely processing. We are particularly impressed with the Mobile App’s attendance capture, eliminating the need for biometric punching. From employee onboarding to performance management, the platform has significantly improved our efficiency. Grateful for the team’s support.

“It’s been over five years since we started using QuickChex software, and it has proven to be incredibly user-friendly and efficient. The platform has consistently made our processes smoother and more streamlined, contributing significantly to our operational ease.”

“We have been using Quikchex Payroll and Employee Management Software since 2017. It is very user-friendly, and the support provided by the team on every module, along with the training, is amazing. The GPS-based attendance module has significantly reduced our payroll processing time from 7 days to 1 day. I have recommended this software to many of my HR colleagues.”

Quikchex provides outstanding support, with a highly knowledgeable and personable team that resolves issues promptly and effectively. Their software handles all payroll and HRMS needs seamlessly, allowing the HR team to focus on innovation. Always just a call away, the Quikchex team handles situations efficiently and positively, making it a brilliant solution backed by an exceptional team.

Can we customize salary structures and CTC templates?

Yes, you can create fully customizable salary structures with flexible pay heads and reusable CTC templates, allowing you to standardize pay components across different employee groups.

How easy is it to process payroll each month?

Payroll processing is streamlined with a few simple clicks. The system automatically handles all payroll elements, including variable payments, arrears, gratuity, TDS, PF, ESIC, and other statutory deductions, making monthly payroll quick and compliant.

Can we manage employee loans and salary advances?

Absolutely! The module supports loan and advance management, allowing you to set up repayment plans with automatic deductions directly integrated into the payroll process.

Is it possible to generate custom payslips?

Yes, you can design and distribute customized payslips that include your organization’s branding and a detailed breakdown of each employee’s earnings, deductions, and net pay.

How does salary disbursement work with this module?

The system generates bank files compatible with major banks, allowing for seamless, automated salary disbursements with minimal manual effort. This simplifies the disbursement process and supports easy reconciliation

Can employees declare investments and submit proofs online?

Yes, employees can declare investments directly in the system and submit their proofs digitally. This feature also ensures accurate tax calculations based on declared investments, streamlining year-end tax compliance.

Does the module support statutory compliance for Indian payroll requirements?

Yes, the module is designed to meet all Indian payroll compliance requirements, including TDS, PF, ESIC, and other statutory deductions, ensuring your payroll is accurate and compliant each pay cycle.

How does the software account for changes in compliance or tax regulations and rates?

Our software is regularly updated to reflect the latest changes in tax laws, statutory requirements, and compliance regulations. This ensures that your payroll calculations, deductions, and filings remain accurate and compliant with current Indian regulations without any manual adjustments.