Comprehensive Compliance Audits for Complete Assurance

Ensure your organization’s operations align with regulatory requirements through detailed compliance audits, covering statutory obligations, documentation, and process adherence to minimize risk

Trusted by over 5000+ HR Managers

Key Features of Our Compliance Audit Service for Companies

Our audit service provides end-to-end verification of your compliance across all key regulatory areas, ensuring your organization meets statutory requirements with confidence

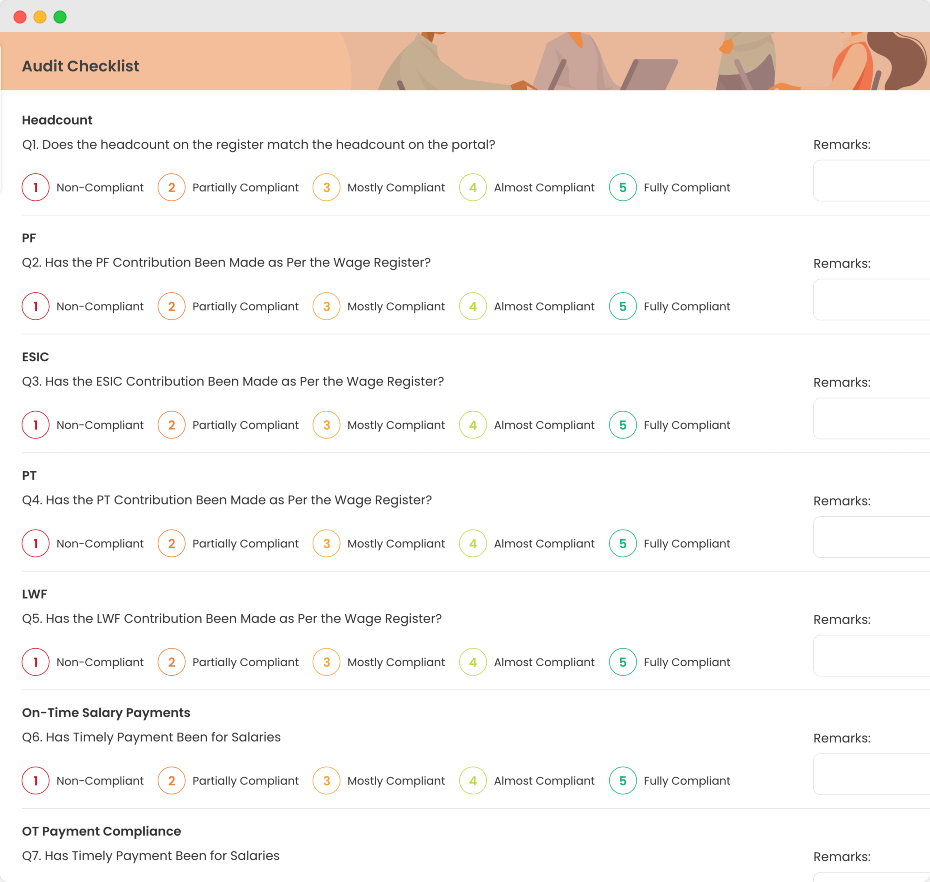

Statutory Audit

Conduct a thorough review of adherence across your organization’s statutory requirements, ensuring every process meets regulatory standards

-

Multi-Law Compliance Check: Verify adherence to laws like the Shops and Establishment Act, Factories Act, PF Act, ESIC Act, and Payment of Wages Act

-

Documentation Review: Ensure all records, registers, and filings are complete and compliant

-

Risk Assessment: Identify compliance gaps and prioritize corrective actions

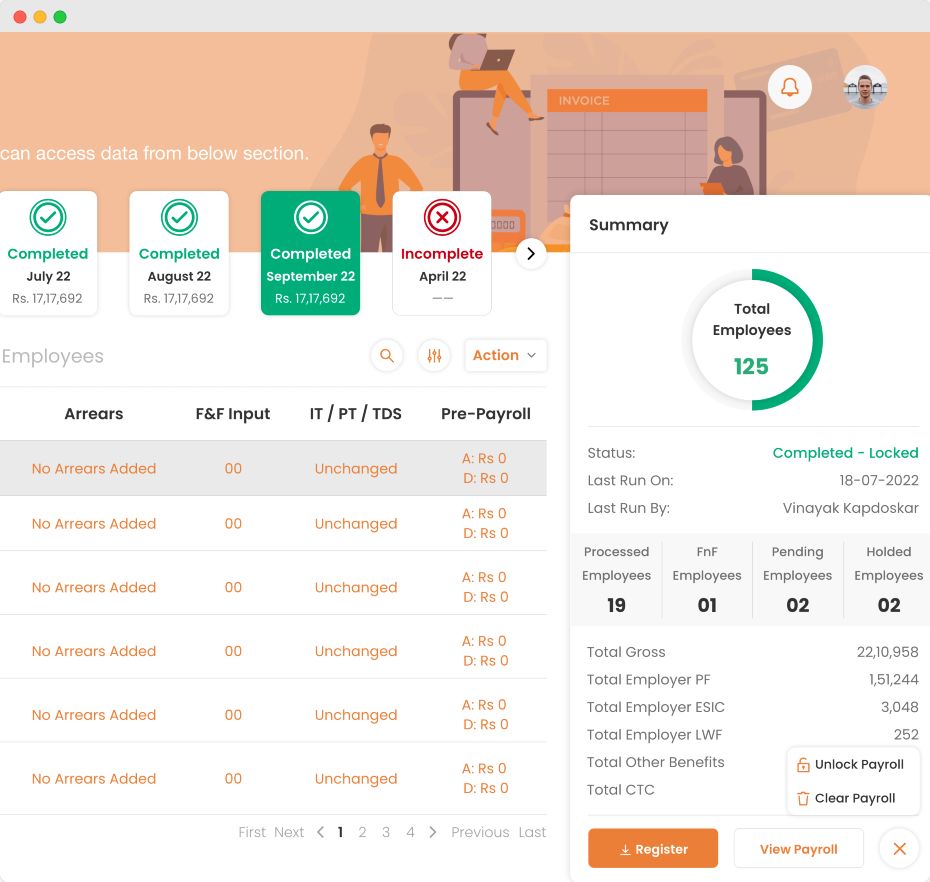

Payroll Compliance Audit

Verify that your payroll processes align with statutory obligations, including tax filings, contributions, and record maintenance

-

PF, ESIC, and PT Verification: Ensure accurate and timely contributions for Provident Fund, ESIC, and Professional Tax

-

TDS Compliance Review: Confirm correct deductions and timely TDS filings for tax compliance

-

Payroll Documentation Audit: Review payslips, salary registers, and payroll documents for compliance

Labour Law Compliance Verification

Ensure full compliance with labour laws covering employee rights, wages, and working conditions, including required records and practices

-

Shops and Establishment Act Compliance: Confirm registration, leave policies, and working hours adhere to regulations

-

Factories Act Compliance (if applicable): Verify health, safety, and welfare measures as per statutory guidelines

-

Equal Remuneration & Maternity Benefits: Ensure fair wages and benefits as mandated by law

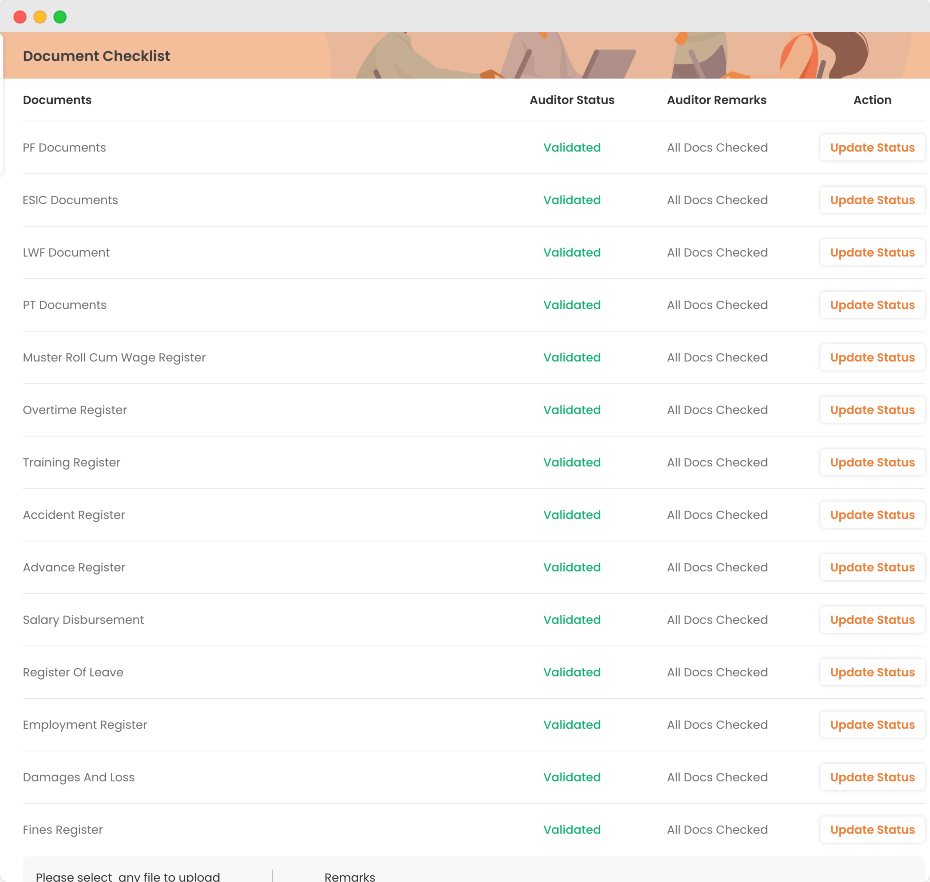

Documentation & Record-Keeping Audit

Ensure accurate record-keeping for required registers, notices, and employee records, minimizing risks during inspections

-

Statutory Register Audit: Audit statutory registers for accuracy and completeness

-

Display Compliance: Confirm display of abstracts and notices as per regulatory requirements

-

Employee Record Verification: Verify employee records are updated and legally compliant

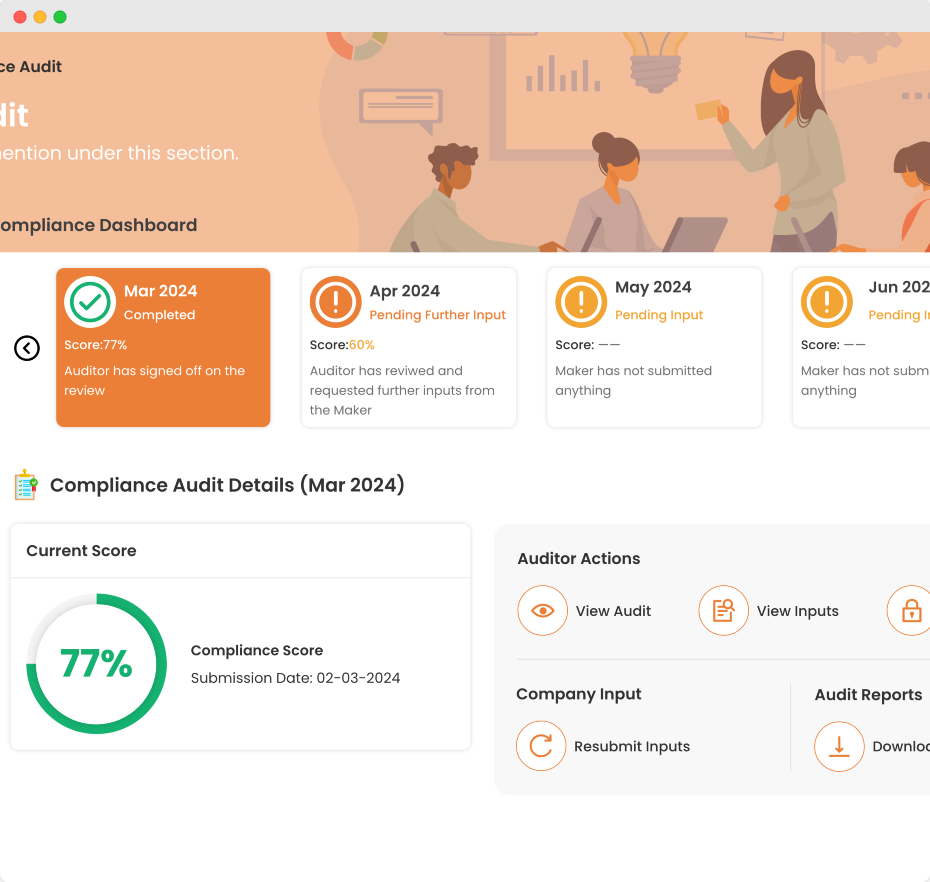

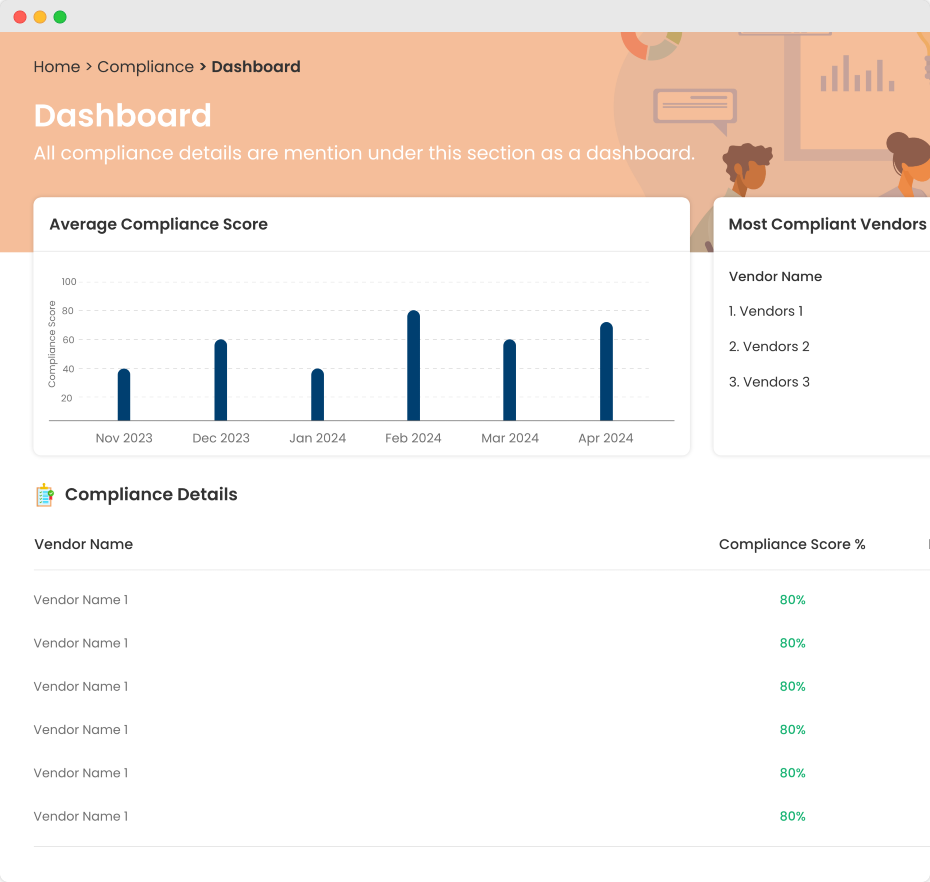

Compliance Dashboard & Analytics

Gain insights into compliance status with a centralized dashboard, providing real-time metrics and historical data for informed decision-making

-

Real-Time Compliance Tracking: Monitor metrics across all statutory areas

-

Compliance Analytics: Generate reports on trends, compliance gaps, and audit findings

-

Actionable Insights: Use data-driven insights to proactively address compliance issues

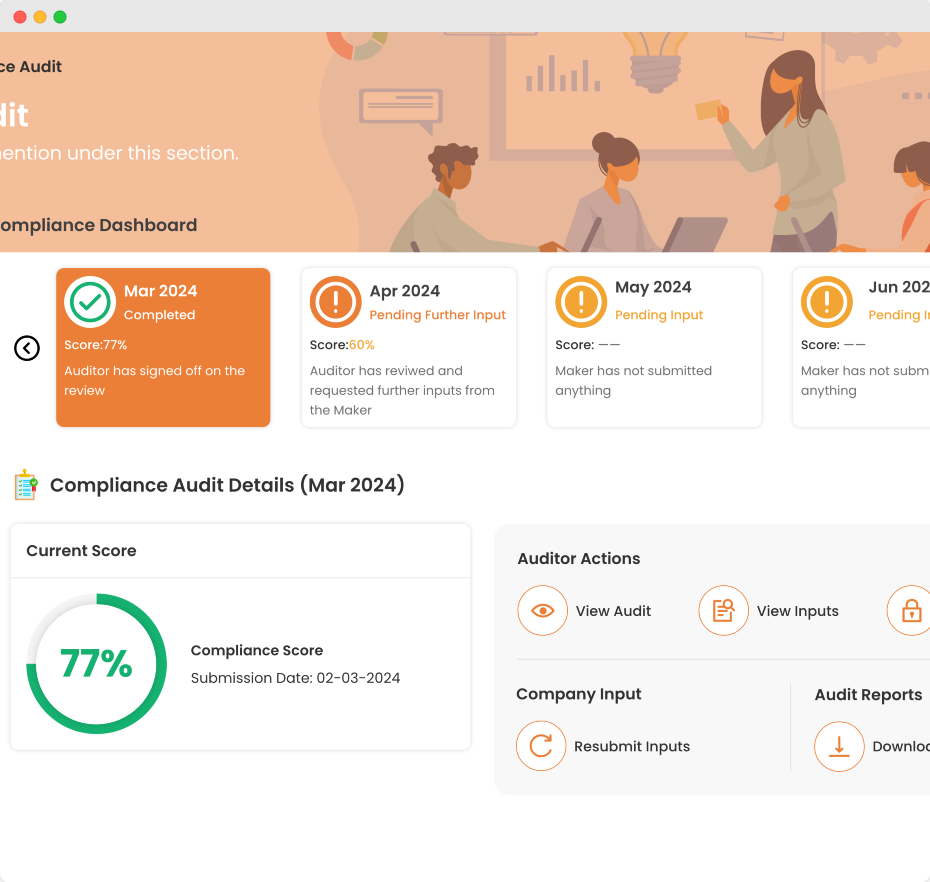

Monthly Compliance Scores

Receive a monthly audit report with a weighted compliance score, summarizing compliance performance across all key areas

-

Weighted Compliance Score: View overall compliance status through a cumulative score

-

Detailed Audit Findings: Access reports highlighting strengths and areas for improvement

-

Progress Tracking: Track compliance over time for continuous improvement

Testimonials

Hear from our users

The Quikchex HRMS platform has been a valuable addition to our HR processes at IIDE. The employee directory works seamlessly, and the leave process setup is intuitive, helping streamline approvals efficiently. The payroll and attendance management modules have also been reliable and easy, making our HR operations smoother.

The user-friendly Quikchex interface has streamlined our processes, saving valuable time. The payroll and attendance system ensures accurate, timely processing. We are particularly impressed with the Mobile App’s attendance capture, eliminating the need for biometric punching. From employee onboarding to performance management, the platform has significantly improved our efficiency. Grateful for the team’s support.

“It’s been over five years since we started using QuickChex software, and it has proven to be incredibly user-friendly and efficient. The platform has consistently made our processes smoother and more streamlined, contributing significantly to our operational ease.”

“We have been using Quikchex Payroll and Employee Management Software since 2017. It is very user-friendly, and the support provided by the team on every module, along with the training, is amazing. The GPS-based attendance module has significantly reduced our payroll processing time from 7 days to 1 day. I have recommended this software to many of my HR colleagues.”

Quikchex provides outstanding support, with a highly knowledgeable and personable team that resolves issues promptly and effectively. Their software handles all payroll and HRMS needs seamlessly, allowing the HR team to focus on innovation. Always just a call away, the Quikchex team handles situations efficiently and positively, making it a brilliant solution backed by an exceptional team.

What is covered under the statutory compliance audit?

Our statutory compliance audit includes checks for adherence to various laws, such as the Shops and Establishment Act, Factories Act, Provident Fund Act, and more. We verify documentation, registers, and compliance across all statutory requirements.

How does the payroll compliance audit work?

We ensure payroll processes meet statutory obligations, including PF, ESIC, Professional Tax, and TDS filings. Payroll documents like payslips and salary registers are reviewed for compliance.

How does the monthly compliance audit report help us track progress?

The monthly report includes a weighted compliance score, highlighting strengths and areas for improvement. This score allows you to track progress and make data-driven adjustments to maintain compliance.

What documentation is reviewed during the audit?

We review statutory registers, employee records, payroll documents, and displayed notices to ensure they meet regulatory standards and minimize risk during inspections.

Can we monitor compliance metrics in real time?

Yes, our Compliance Dashboard provides real-time tracking and analytics, allowing you to monitor compliance, view trends, and proactively manage compliance.

How does the labour law compliance audit ensure adherence to employee rights?

Our audit covers key labour laws, ensuring adherence to regulations around wages, working conditions, and benefits, including compliance with the Equal Remuneration Act and Maternity Benefits Act.